Egnyte Content Cloud for Banking and Credit

Securely modernize operations with hybrid-cloud solutions, automated compliance, and customer-centric document collaboration tools.

Modern, Secure Document Management for Customer-Centric Banking and Lending Operations

The banking and credit sector, including banks, credit unions, and lenders, faces rising regulatory, cybersecurity, and efficiency challenges.

Modernize Banking Operations

Optimize operations and eliminate inefficiencies caused by outdated infrastructure with a scalable hybrid-cloud platform.

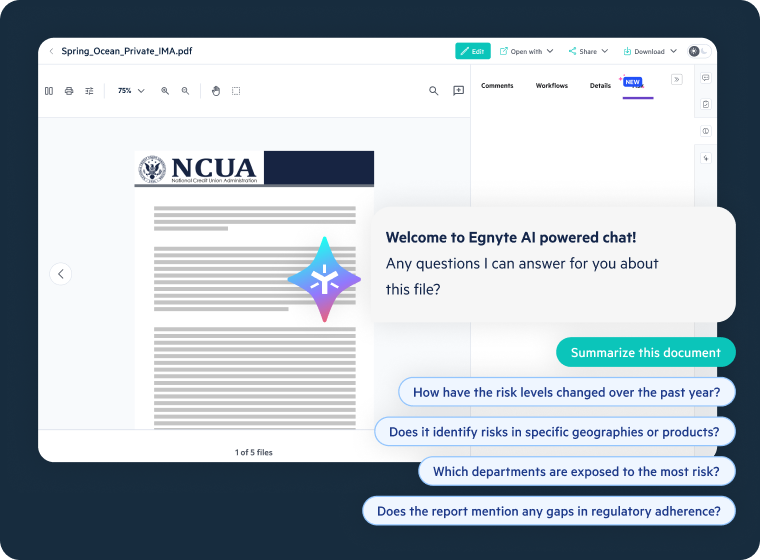

Intelligent Document Insights

Access and summarize key data scattered across documents, like operating procedures and audit reports, to empower compliance and decision-making.

Mitigate Security and Compliance Risk

Safeguard against breaches and simplify compliance with data regulations such as SOX, BSA/AML, and PCI DSS using advanced tools.

Streamline Collaboration, Surface Insights, and Simplify Compliance With Egnyte

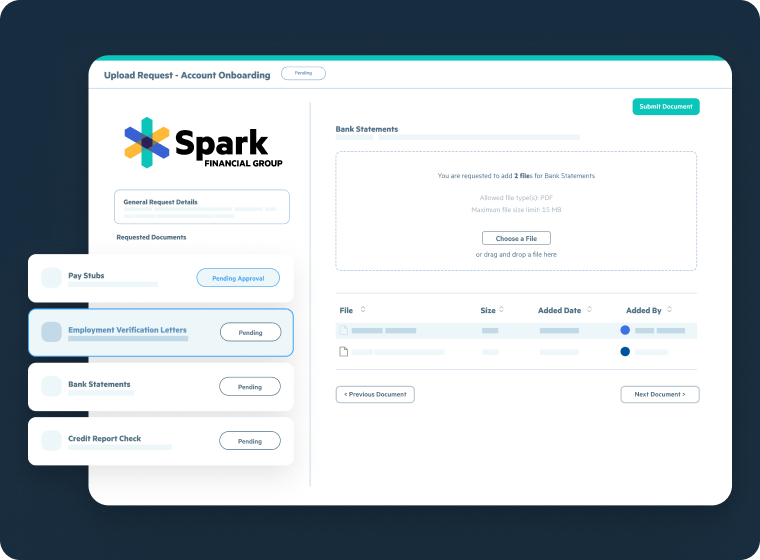

Secure Hybrid-Cloud Collaboration

- Accelerate loan approvals and account openings with templated document requests and workflows

- Monitor and control external sharing with a central dashboard and discretionary controls

- Improve productivity with M365 coediting and Salesforce, API, and other integrations

- Maintain legacy systems with the full advantages of the cloud with hybrid deployments

Surface Faster Customer Insights

- Accelerate underwriting and approvals with quick AI extraction of scattered data points

- Automate classification of documents for faster, more accurate search and discovery

- Gain fast, actionable insights from customer data with summaries and suggested prompts

- Use generative AI that respects user permissions and governance policies

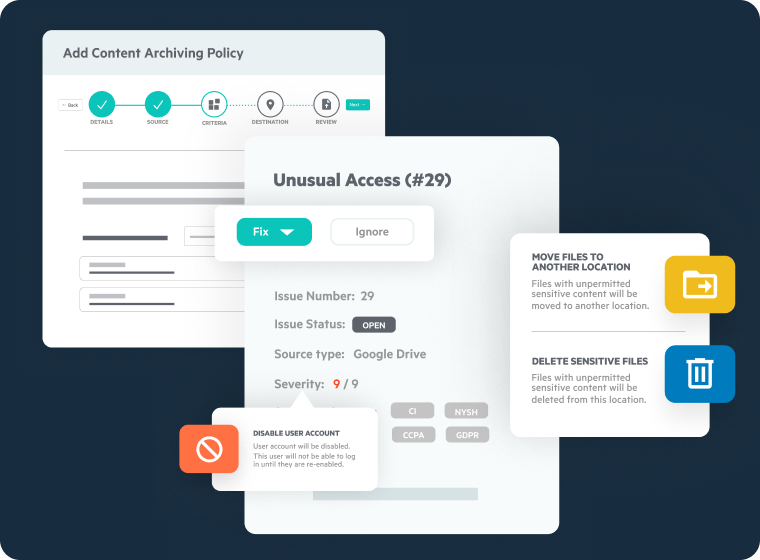

Governance and Security You Can Trust

- Automate compliance with Federal Reserve, NCUA, OCC, FTC, CFPB, GLBA, and more

- Preserve client trust with content classification and protection to prevent breaches

- Protect sensitive content with suspicious behavior monitoring and ransomware detection and recovery

- Reduce vulnerabilities through least privileged access and detailed audit logs across multi-repository architectures